Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

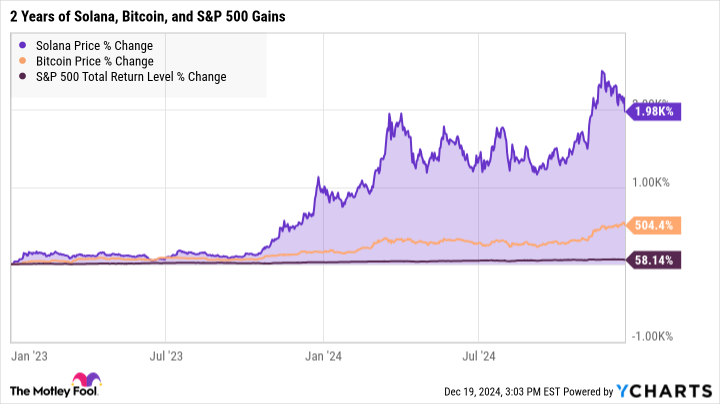

The stock market had a strong 2024, with the S&P 500 delivering a total return of 25%. However, the crypto market’s performance was even more impressive. According to CoinMarketCap, the combined cryptocurrency market cap doubled in less than a year, rising from $1.65 trillion at the end of 2023 to $3.30 trillion by December 19, 2024. Bitcoin, the crypto pioneer, saw a 138% increase, while smart contract innovator Solana surged by an astounding 2,000% since its December 2022 low, significantly outperforming Bitcoin and the broader market. This raises a crucial question for investors: is it time to rebalance portfolios and favor Solana over Bitcoin?

While Solana’s 2,000% gain is eye-catching, it’s essential to consider the context. Solana was deeply impacted by the FTX exchange collapse, plummeting from $259 to around $10 in a short period. This drastic drop created an artificially low starting point for its subsequent recovery. Although Bitcoin also felt the effects of the FTX fallout, its price decline was less severe. Therefore, Solana’s dramatic gains should be viewed as a rebound from a significant downturn, rather than a purely organic surge from a stable base. This doesn’t diminish the recovery, but it provides a necessary perspective.

Despite the turbulent past, Solana possesses inherent strengths that contribute to its resurgence. It remains a leader in high-speed smart contract execution, making it highly suitable for automating financial transactions and managing asset-based changes. This speed is particularly valuable for applications requiring rapid processing of numerous decentralized programs, such as:

The potential for everyday applications, such as quick payments for goods and services, further underscores Solana’s utility. This focus on speed and efficiency positions Solana as a key player in the evolving landscape of decentralized applications.

While Solana’s recent performance is compelling, completely abandoning Bitcoin in favor of Solana is a high-risk strategy. Bitcoin remains the dominant cryptocurrency with the largest market capitalization and the longest track record. It serves as a benchmark for the entire crypto market and is often seen as a store of value. Solana, while promising, is still subject to greater volatility and faces competition from other smart contract platforms.

A more prudent approach is to maintain a diversified portfolio. Consider allocating a portion of your crypto holdings to Solana to capitalize on its growth potential, while still retaining a significant position in Bitcoin for stability. Regularly reviewing and rebalancing your portfolio based on market conditions and your risk tolerance is crucial. Solana’s recovery and focus on practical applications suggest it has a bright future, but diversification remains key in the volatile crypto market.

Hashtags:

#Solana #Bitcoin #CryptoInvesting #SmartContracts #DeFi #NFTs #CryptocurrencyMarket #PortfolioRebalancing #BlockchainTechnology #DigitalAssets